georgia property tax exemptions for veterans

4000 off school taxes. These benefits are in addition to the benefits provided by the Department of Veterans.

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Discount on property taxes based on disability percentage.

. Veteran is deemed 100 percent disabled per VA assessment. Georgia Property Tax Exemptions. Up to 50000 plus.

Secretary of Veterans Affairs. Many state governments offer property tax exemptions to qualified veterans with disabilities. On bill with home and 5 acres you would get total school exemption and on bill with balance of acreage no exemptions.

Exemptions may vary based on which county the. Exemption from Homestead Tax 100 disabled veterans those getting VA disability for loss of vision or limbs and their surviving unremarried spouses may be exempt from property tax on their homes. Letter from VA stating the wartime veteran was.

4000 off school bond taxes. Must be 65 on January 1 - 100 exemption on house and ten acres OCGA. With respect to all homestead exemptions the Board of.

People living in the house cannot have a total income of more than 30000. 7000 off recreation taxes. A Rundown on Veterans Property Tax Exemptions by State.

If you or your loved one is a veteran you may qualify for a partial or full property tax exemption. One or both hands. Secretary of Veterans Affairs.

12500000 is subtracted from your assessed value before your bill is calculated. Start Your Free Trial Now. Georgia Homestead Tax Exemption for Disabled Veteran Surviving Spouse or Minor Children.

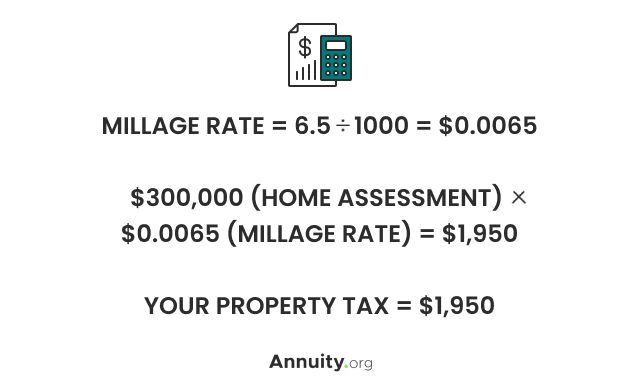

You have market value and assessed value. To qualify for the Georgia disabled. The exemption is subtracted from the assessed value.

The state taxes the assessed value which is equal to 40 of the market value. A disabled veteran or the unmarried surviving spouse of such a veteran qualifies for a substantial Georgia property tax exemption based a complex set of rules. The current amount is 85645.

The Local Homestead Exemption is available to all homeowners 65 and older with a net income of less than 1000000. Ad Save Time Editing PDF Documents Online. In the year of application for the Veterans exemption applicants must present a letter from the Veterans Administration defining their condition.

Our breakdown of veterans property tax. Georgia Disabled Veteran Property Tax Exemption. Homeowners must apply between January 1st and April 1st.

A summary for veterans dependents and survivors State Benefits for Georgia Veterans Other State Tax Exemptions Abatement of State Income Taxes Georgia law provides that service personnel who die as a result of wounds disease or injury incurred while serving in a combat zone as a member of the armed forces of the United States are. If a member of the armed forces dies on duty their spouse can be granted a property. Unless you live in states with low property taxes such as Alabama Hawaii and West Virginia you may need help covering your tax bills.

Not specific to veterans. Luckily there are plenty of ways you can lower your property taxes in the event you have to pay them in full. For more information on tax exemptions visit dorgeorgiagov call 404-724-7000 contact your county tax commissioners office or consult a tax professional.

4000 off county bond taxes. However since the amount of coverage and rules for eligibility vary from one state to the next you may still need some extra help. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US.

10000 off county taxes. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US. Disabled Georgia vets with qualifying disabilities 100 VA ratings loss or loss of use of hands feet eyesight etc may receive a property tax exemption up to 60000 for a primary residence.

Find Georgia state and local active duty and veterans benefits including education employment healthcare tax breaksexemptions recreation and much more below. Property in excess of this exemption remains taxable. State Benefits for Georgia Veterans Other Homestead Tax Exemptions There are a variety of homestead tax exemptions for Georgians who own their home and use it as their primary residence.

Georgia disabled veteran benefits include an annual homestead property tax exemption of up to 60000 plus an additional sum set by the VA which is currently 90364. Paying your property taxes is no easy feat. Texas Property Tax Exemptions.

Georgia Property Tax Exemptions For Veterans. Do 100 disabled veterans pay property tax in Georgia. Disabled veterans their widows or minor children can get an exemption of 60000.

Veteran Requirements Property Tax Exemption. Arkansas veterans with a 100 Permanent and Total PT VA disability rating are exempt from paying property taxes on their primary residence. Texas veterans with VA disability ratings between 10 and 100 may qualify for.

This makes the current total property tax exemption 150364 for Georgia disabled veterans. School Tax Exemption - Age 62. Suite 203 - Real Property Tax Returns and Homestead Applications.

Upload Edit Sign PDF Documents Online. A similar exemption is available to the unmarried surviving spouse of a United States armed forces member who died in a war or conflict. Veterans Exemption - 100896 For tax year 2021 Five ways to be eligible.

100 disabled persons of any age can apply for this exemption. The amount for 2021 is 100896. Up to 25 cash back Veteran Exemptions From Georgia Property Tax.

To qualify for the exemption the veteran must own the property and must have a 100 Permanent and Total PT VA disability rating OR have been awarded Special Monthly Compensation by VA for 1 The loss or loss of. A disabled veteran can also be exempt from paying property or title tax on any single vehicle they own if their disability meets one of the following criteria. The state of Georgia has one of the largest population of veterans with over 700000 veterans.

Residents over 65 with a household net income under 10000 a year may be eligible. Veteran has lostor permanently lost the use ofany of the following. There is a 1250000 exemption for the County portion of the tax bill.

A disabled veteran or the unmarried surviving spouse of such a veteran qualifies for a substantial georgia property tax exemption based a complex set of rules. Georgia offers a homestead property tax exemption for eligible disabled Veterans their Surviving Spouse or minor Children. The exception 85645 would be subtracted from the 40000.

The maximum exemption amount allowed by the state is 40000. 100 permanently disabled or entitled to receive certain statutory awards from the VA. One or both feet.

Learn more about the Georgia National Guard Income Tax Credit. Must be 100 permanently disabled or over age 65 with less than 12000 in annual income. The maximum exemption amount allowed by the state is 40000.

Homeowners To See Higher Property Taxes Thanks To The Pandemic Here S What They Can Do Equitax

Property Taxes By State In 2022 A Complete Rundown

Property Taxes By State In 2022 A Complete Rundown

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

The Cook County Property Tax System Cook County Assessor S Office

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

What States Do Not Have Property Tax Quora

Do Military Veterans Get Property Tax Breaks In The U S Mansion Global

States With Property Tax Exemptions For Veterans R Veterans

Homeowners Are You Missing Exemptions On Your Property Tax Bills Cook County Assessor S Office

Property Taxes Calculating State Differences How To Pay

Property Tax Exemption Who Is Exempt From Paying Property Taxes

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Homeowners To See Higher Property Taxes Thanks To The Pandemic Here S What They Can Do Equitax

What Is A Homestead Exemption And How Does It Work Lendingtree

Understanding Mississippi Property Taxes Mississippi State University Extension Service